Whether you’re a freelancer or running your own small business or startup, you’ve got to get paid—preferably on time.

A surprising number of businesses that are bringing in good revenue struggle to keep their business afloat because they struggle with cash flow—having the cash in hand to cover expenses.

It’s an accounts receivable problem. Many times, this struggle isn’t because they haven’t done enough business, it’s because they just haven’t been paid yet for products or services already delivered.

That’s where a simple, professional looking invoice can make a big difference. You want your invoice to make it easy for your customers to understand what you’re billing for, how much they owe, and when payment is due. Invoicing can take some time, but there are some ways you can make it quicker and simpler.

Start with a quality, free invoice template—there are a number of different invoice types. Here are a few we recommend.

1. An Excel invoice template (and a good Google Sheets option)

If you’d prefer an Excel template, this option from Vertex 42 is tried and true. It’s a fast, small download and a straightforward template with two style options.

Personally, I think the online templates are just as good as a download like this and, given the number of options now available online, it isn’t really necessary to use Excel. However, if you’re a die-hard Excel user, this is a good one to try.

A Google Sheets template can also be a good option if you don’t have Excel but like the Google doc, spreadsheet-based approach.

2. QuickBooks web-based invoice generator

This is one of the most customizable free professional invoice templates we’ve seen online. You can use this tool right away, without needing a credit card or a login. Create as many invoices as you need (there’s no limit), and print or download them as PDF files.

You can add your logo if you like, and there’s a choice of three customizable design layouts. You can also choose from a range of fonts, font sizes, and colors.

You can print or enter your email address to download, and you’ll also have the option to also have some free accounting resource guides sent to you.

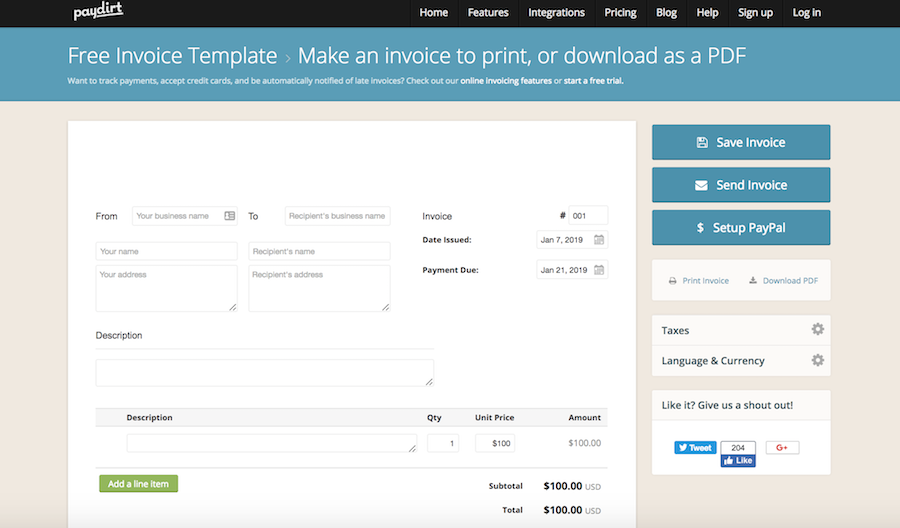

3. Paydirt’s PayPal compatible invoice template

In addition to their pay-to-use invoice and time-tracking app, Paydirt offers a free invoice template. One of the things that makes this template unique is that you can connect it to your PayPal account, giving your clients an easier, more immediate way to pay you.

The template itself isn’t anything special, but if connecting your invoice directly to a PayPal account is a top priority, this is the way to go. They also have a great blog with tons of tips for freelancers, so you should at least check this site out.

4. Xero’s fillable PDF template

Xero offers a downloadable fillable PDF template that you can save and reuse. It’s not fancy, but it’s clean and efficient, and you can save the template itself to your computer, which is convenient.

If you’re emailing invoices to your clients, it’s never a bad idea to send them in PDF form, so they can’t be edited. Sending Word docs or even Google docs with opening editing access can just make things more complicated if the client (even unintentionally) edits the invoice and then gets confused about what they owe and when.

5. Freshbooks’ web-based invoice template

This invoice template is definitely no-frills. If simple is your thing, it’s a good one to test drive. It does allow you to customize various aspects of the template, though, including the option to upload a business logo.

Because it’s a web-based invoice generator, you won’t be able to save your changes, so it’s probably most useful if you’re not generating invoices very often—retyping your own business information will get old.

Should you use a paid invoice tool?

If you’re freelancing or in the early days of your small business or startup, you can probably get by with using free templates for a while, sending your invoices as email attachments, or even handing them to your customers in person. At some point, as your customers increase and managing your cash flow gets a little more complicated, you’ll probably start thinking about using an accounting tool like Quickbooks or Xero.

You might start using a service like Paypal to receive payments online. Those services all offer integrated online invoicing tools, which can save you time and effort, and many include an online “pay now” option, which can reduce the amount of time you wait to get paid.

Tips for getting the most out of your invoice templates

For a refresher on how to invoice and what should be included, check out our starter guide.

Every invoice should include these line items:

- The date

- Your name (and your business name)

- Your business address and contact information

- Your customer’s name and address

- Description of items or services purchased, including prices and inventory numbers,

- Terms of payment (when payment is due)

- What types of payment you accept

Keep your invoices simple and clean, and remember, they’re essentially marketing material. They don’t have to be professionally designed, but don’t clutter them up with jargon that your customer won’t understand about your service or product, or use hard to read fonts or colors when you customize your invoice.

Make sure there’s no doubt that they understand what you’re billing for and a due date for when you expect cash in hand. And don’t wait too long to send it to your customer—you want your product or service to be fresh in their mind when their bill arrives.

from Bplans Articles http://bit.ly/2RhC5zr

No comments:

Post a Comment